The rise of digital customer service

When it comes to communication, digital is everywhere. Whether it’s through WhatsApp, Facebook Messenger, Twitter or email, we are naturally using a number of channels throughout the day to communicate with friends and family. When it comes to contacting brands, we expect to have the same experience, instead of going through painful journeys. According to CITE Research, 72% of customers expect to use their favourite channel to engage with brands.

The expectation for seamless experiences

In the insurance industry, customers have several reasons to contact their provider: for sending documents, asking for information about their subscription or services, or making a claim.

Customers are increasingly making this type of enquiry in micro-moments (between appointments, while queueing, in public transport), meaning that they have limited time to complete the request. When doing so, they want the simplest possible experience, and not being faced with long waiting times or complex web interfaces such as ticketing systems.

AXA: A stronger relationship with customers and increased agent productivity

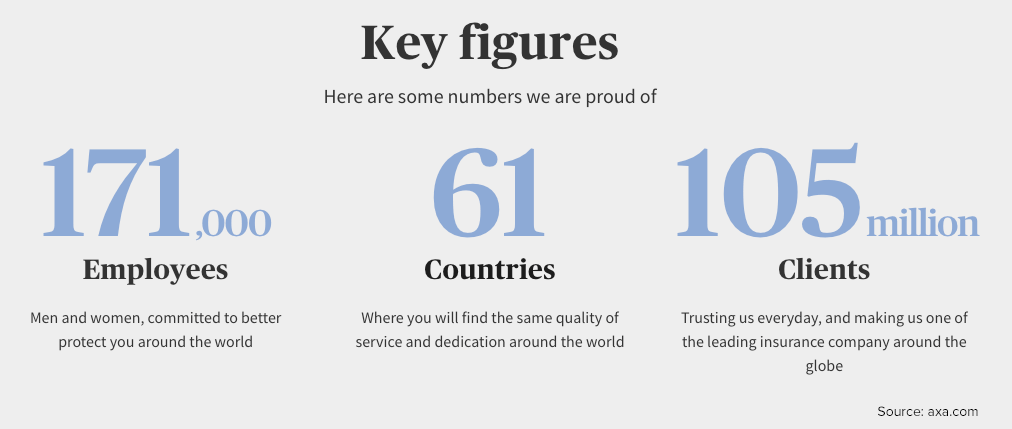

AXA is a global insurance leader that has more than 107 million customers across 61 countries. The company’s areas of expertise are applied to a range of products and services across three major business lines: property-casualty insurance, life & savings, and asset management.

In Switzerland, AXA is the largest insurance provider with 1.9 million customers, including 40% of all companies in the country. They realised a growing preference among customers for digital channels when it comes to customer service. In particular, the conversational interfaces of messaging apps are appreciated by customers, as it is close to their daily habits.

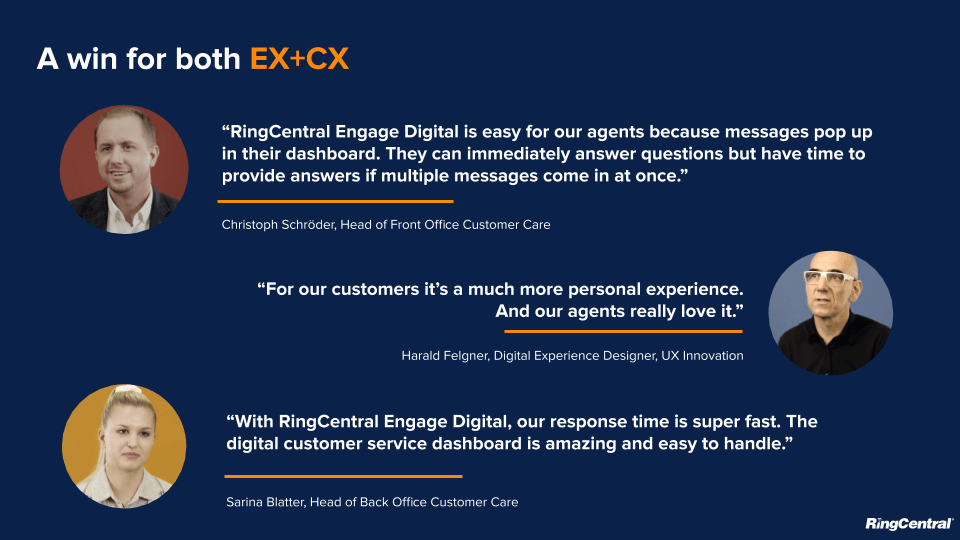

According to Harald Felgner, Digital Experience Designer, UX Innovation for AXA Switzerland, “Social media messaging services represent the next paradigm of interactions with customers. These types of interactions are a game-changer.”

To embrace this trend and build stronger relationships with customers, AXA decided to increase the number of digital touchpoints supported by customer service.

However, the solution that AXA was previously using did not provide any context of past interactions. Call centre agents had to search each digital channel to see if a customer had written a message or a comment on a Facebook post, for example.

AXA was looking for a partner to roll out new digital channels and simplify customer engagements with conversational user interfaces.

Finding the right fit in the cloud

AXA needed a solution with the ability to unify the management of digital channels and optimise their agents’ productivity. The company wanted to move away from software that was forcing inconvenient experiences, as Christoph Schröder, Head of Customer Care Front Office at AXA explains. “One of our big goals is customer first,” says Christoph, “so we want to try to do everything for the customer and not for our internal processes.”

To innovate and provide the best possible service, AXA was looking to adopt the latest messaging channels available to companies such as WhatsApp and Apple Business Chat.

AXA chose to implement the omni-digital platform RingCentral Engage Digital, enabling agents to manage all digital interactions from a unified interface. After an initial concept rollout, the company decided to adopt the software. Some of the main reasons for this choice were the ability to integrate all digital channels and the ease-of-use which simplifies agents’ daily work.

This enabled AXA to adopt WhatsApp Business Solution and Apple Business Chat as well as managing existing channels: Facebook, Twitter and live-chat. Thanks to the software’s AI-based smart routing, messages are categorised and pushed to the right agent based on urgency and skills. With the merging of customer identities across channels, agents get a complete view of the customer and access to the historical context to better answer their issues.

Another major benefit for AXA is to increase the role of messaging and introduce it as an alternative to phone calls. Thanks to asynchronous messages, customers can post their questions on their messaging app of choice and return for the answer at a time that is convenient to them.

Agents can immediately process interactions and have time to provide answers if multiple messages come in at once. This is quite different to handling customer service on the phone, where agents can only respond to one customer and are expected to immediately provide an answer to any question.

The benefits of RingCentral Engage Digital for AXA

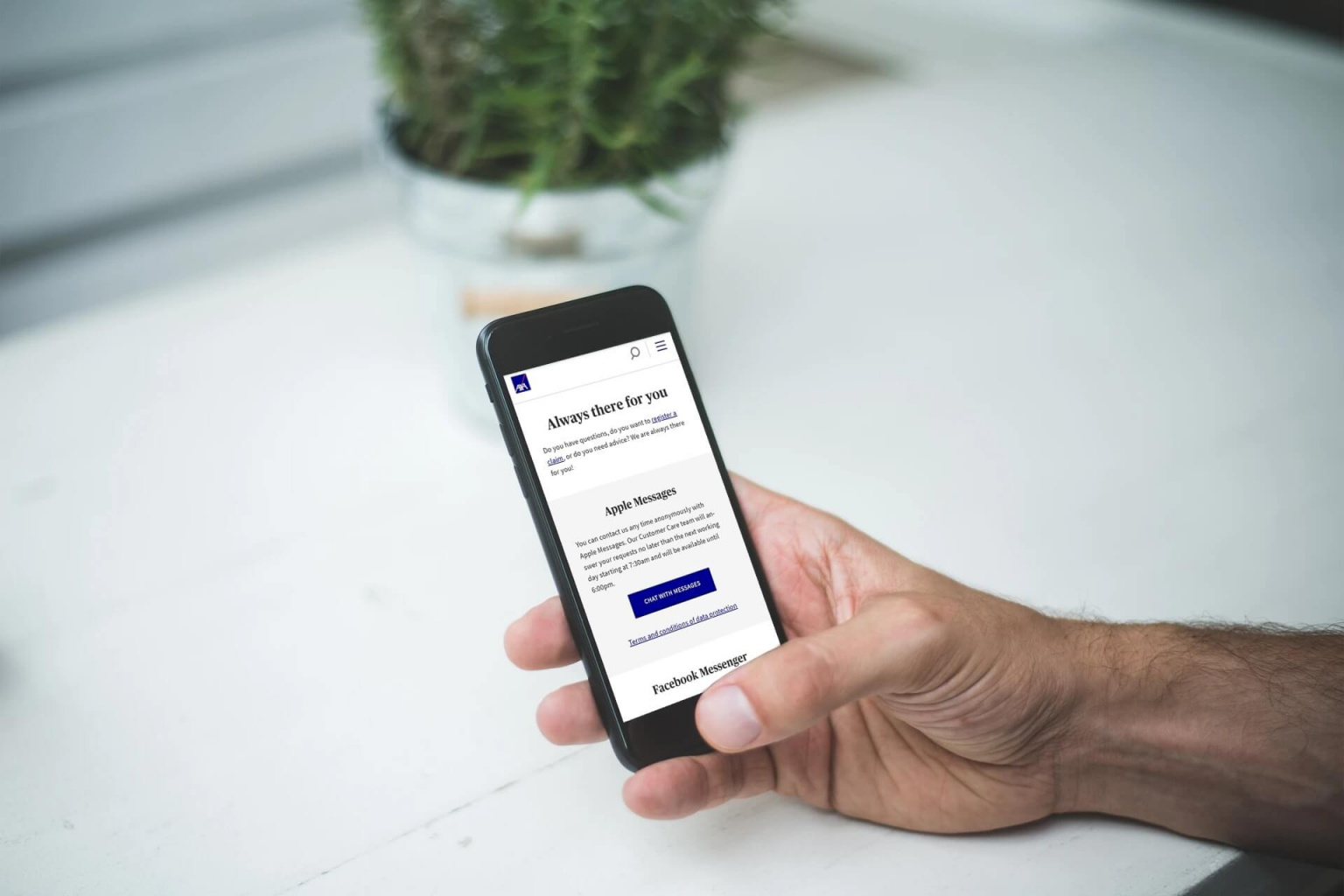

The adoption of RingCentral Engage Digital translated into several benefits, both for AXA and its customers. On the customer side, the experience is much easier and personal than before: previously, AXA Switzerland’s contact page only featured phone and web forms. Now, customers are also given the choice of three different messaging apps.

Customers can now use the messaging apps they already have installed on their phone to contact AXA. Rather than waiting on the phone, they can send their request and be notified when the answer is available. When AXA launched these new channels, it received very positive feedback from customers, who enjoyed being able to communicate in such a simple way with their insurer.

The adoption of RingCentral Engage Digital by AXA has led to:

- 50% month-on-month increase in digital interactions,

- 10x increase in case resolution, and

- 50% reduction in time to reach a resolution.

The solution enabled the company to manage the additional volume of messages coming from new channels. Agents described the interface as very intuitive, which reduced the training time. Sarina Blatter, Head of Customer Care Back-Office, explains, “RingCentral Engage Digital changed the way we talk to our customers. We are much faster to react to a message, every customer is happier.”

This new approach to customer service supports AXA in its digital transformation plan and customer-first strategy. By relying on RingCentral Engage Digital SaaS platform, AXA can manage the growth of digital interactions without additional resources. The company can also innovate easily and integrate new channels that may become popular among customers.

With the multiplication of digital channels, unifying their management becomes essential for companies. By relying on cloud solutions, they can reduce implementation time and scale faster, to meet customer expectations on the channels they use daily.

RingCentral Engage Digital is one of the components of RingCentral’s cloud-based Contact Centre product, which helps companies meet customer expectations and future-proof their customer service. To learn how to embrace digital customer care, meet us at Call & Contact Centre Expo on 18-19 March in London. Schedule a contact centre consultation with one of our experts and we’ll provide the coffees.

Originally published Mar 03, 2020, updated May 28, 2021